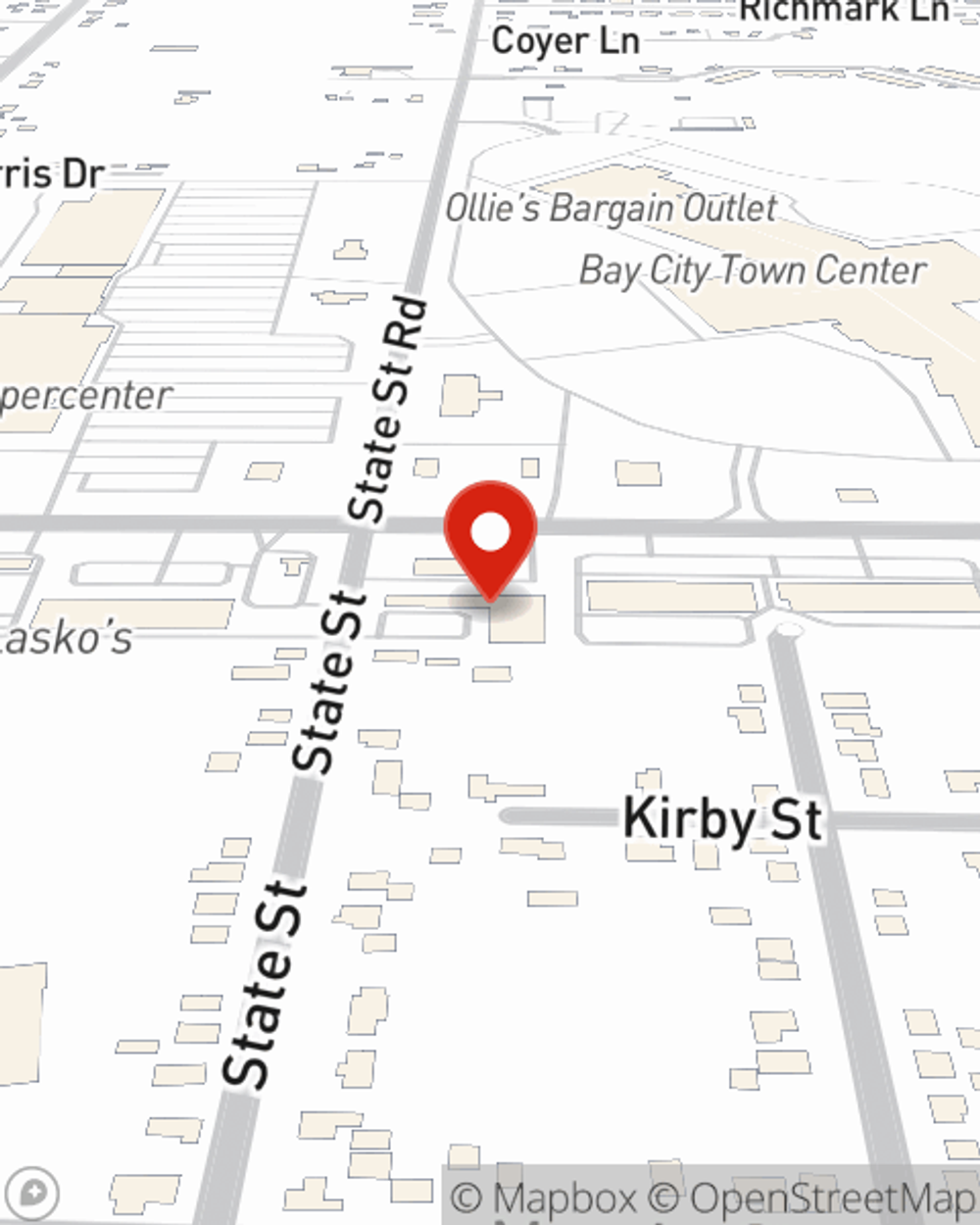

Homeowners Insurance in and around Bay City

Looking for homeowners insurance in Bay City?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Saginaw

- Midland

- Birch Run

- Auburn

- Freeland

- Kawkawlin

- Pinconning

- Caro

- Lansing

- Hale

- West Branch

- Charlotte

- Saint Charles

- Zilwaukee

- Mount Pleasant

- Hemlock

- Clio

- Akron

- Reese

- Mungar

- Grand Rapids

- Alma

- Clare

- Standish

Welcome Home, With State Farm Insurance

With your home insured by State Farm, you never have to worry. We can help you make sure that in the event of damage from the unpredictable tornado or fire, you have the coverage you need.

Looking for homeowners insurance in Bay City?

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Bay City Choose State Farm

Preparing for life's troubles is made easy with State Farm. Here you can create a plan that's right for you or file a claim with the help of agent Jon LaPorte. Jon LaPorte will make sure you get the thoughtful, great care that you and your home needs.

Now that you're convinced that State Farm homeowners insurance should be your next move, get in touch with Jon LaPorte today to see what we can do for you!

Have More Questions About Homeowners Insurance?

Call Jon at (989) 895-5570 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.

Jon LaPorte

State Farm® Insurance AgentSimple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.